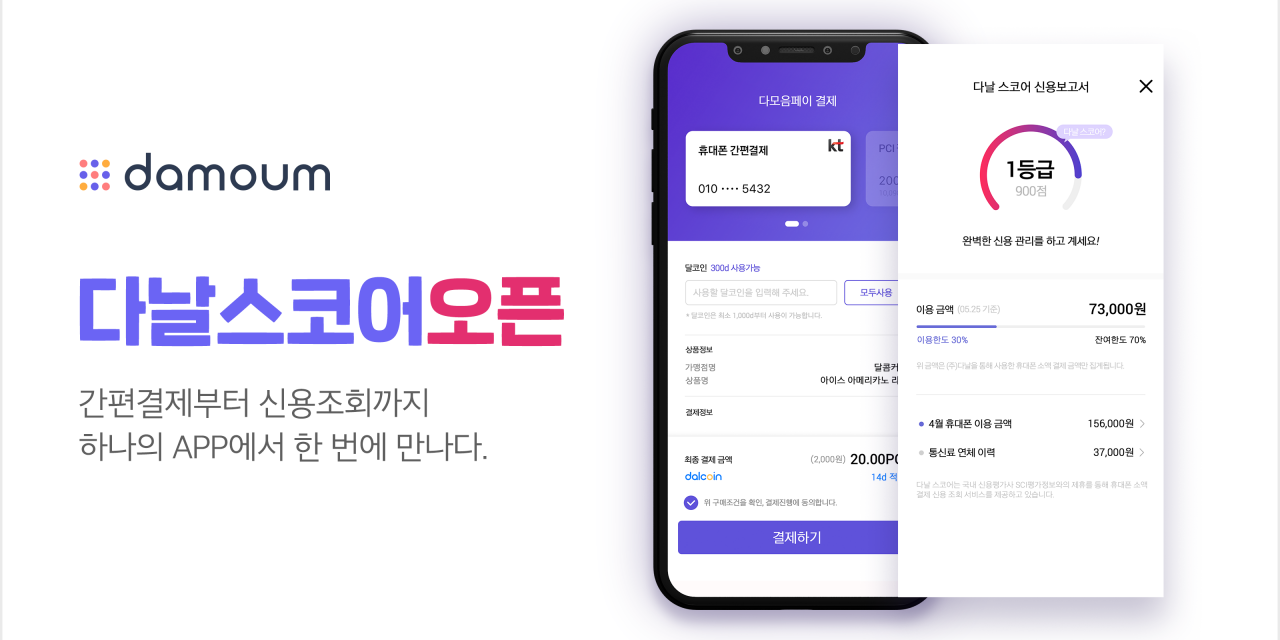

Amid the launch of a variety of life-friendly financial services in line with the untact era, Danal opened the mobile payment-based credit rating service ‘Danal Score’.

Danal Score is a service that allows you to inquire credit ratings based on the user’s mobile phone payment history on the simple payment platform ‘Damoum’. The score is calculated by combining the mobile phone payment data held by Danal with financial data from credit rating agencies. Unlike existing financial history-based credit rating services, it uses non-financial information called mobile phone payment history, providing an opportunity to broaden the breadth of credit rating standards.

Through the service, even customers with a lack of financial history, such as newcomers or low credit rating holders, can benefit from using loans at low interest rates. It also provides information such as mobile phone usage charges and telecommunication charges overdue history to help customers smart credit management.

Danal is promoting my data business for financial platforms from simple payment to credit inquiry in Damoum app. The My Data business breaks away from the corporate-centered financial information management system, and allows customers to directly become the subject of financial information and enjoy more diverse financial benefits.

Park Ji Man, head of the payment business division at Danal, said, “You can analyze payment details through Danal Scores, and receive systematic asset management services such as expenditure statistics and household account book management. In the future, we plan to promote advanced my-data business by combining non-financial data based on mobile phone payment data with financial data from financial companies, credit card companies, and insurance companies, and we will prepare for a leap forward as a comprehensive payment service provider based on our stable payment service.”

번역: 김동우 기자

관련

기사제보 및 보도자료: press@blockmedia.co.kr

▶ 블록미디어 유튜브 바로가기 https://www.youtube.com/blockmedia

▶ 블록미디어 텔레그램 바로가기 https://t.me/blockmedia

▶ 블록미디어 페이스북 바로가기 https://www.facebook.com/blockmediakorea/