Blockstream Chief Strategy Officer (CSO) and Pixelmatic CEO Samson Mow, is skeptical about Bitmain’s cash flow situation in an interview with the Block Media. Blockstream is the leading provider of blockchain technologies at the forefront of work in cryptography and distributed systems. Samson founded Pixelmatic in 2011 to create engaging social games.

Jihan Wu and Micree Zhan founded Bitmain, an operator of Antpool, one of the largest Bitcoin mining pools. Bitmain generates a high-grade Bitcoin mining hardware.

The following are questions and answers he made with the Block Media.

Samson Mow, Blockstream Chief Strategy Officer (CSO) and Pixelmatic CEO

(Question) From IPO request submitted by Jihan Wu, Bitmain’s revenue seems very promising. However, it seems like we are missing something. What part should we carefully look into from his report and request sheet?

(Answer) If you look at their Pre-IPO deck, they claimed profits in Q1 2018 were 1.137 billion yuan, but profits in the first half of 2018 were only 742 million yuan. That means Q2 was a loss of 395 million yuan.

http://www.hkexnews.hk/app/sehk/2018/2018092406/Documents/SEHK201809260017.pdf (page 189)

The other important numbers to look at were the 252 million yuan in failed chips (page 194) and 391.3 million yuan in written off inventory. Bitmain is in a very poor competitive position currently.

Q: You have mentioned Bitmain’s asset with Twitter. In twitter, it was said that Bitmain sold Bitcoin and bought Bitcoin Cash. Is that right?

Then, Bitmain is currently making losses?

A: Yes, they are selling BTC for BCH.

If they didn’t sell their BCH, it’s just a paper loss, but BCH has decreased in value far more than BTC so this tactical error has put Bitmain in an even poorer position to IPO. They’ve essentially bet the entire company on BCH, and public sentiment towards BCH is extremely negative.

Q: As one of the company’s leader, do you think it was the right decision?

A:Betting on BCH is probably the worse decision Bitmain’s management could have possibly made.

Q: What do you think of Bitmain’s current situation and future?

A: I don’t think Bitmain will have a successful IPO if they do manage to get approval to list in Hong Kong. Investors that do their due diligence will see that they are an incredible risk investment. Investing in Bitmain is putting money into a company that has gambled away their market leadership position. Bitmain also is far behind their competitors in terms of technology and R&D. Currently, Ebang’s 10nm chips already perform better than Bitmains 7nm chips.

Q: What about Bitcoin Cash?

A: Bitcoin Cash is just a forkcoin – that is, a coin that is copied from Bitcoin. There are many forkcoins out there on the market like Bitcoin Gold and others. However, Bitcoin Cash is special because they are supported by known frauds and criminals that work to trick people new to the cryptocurrency space that it is the “real Bitcoin.”

Q: Then, why did Jihan Wu plan to pursue an initial public offering in Hong Kong?

(Bitcoin and other digital currencies have lost roughly two-thirds of their value this year, and Hong Kong has been one of the world’s worst-performing stock markets. )

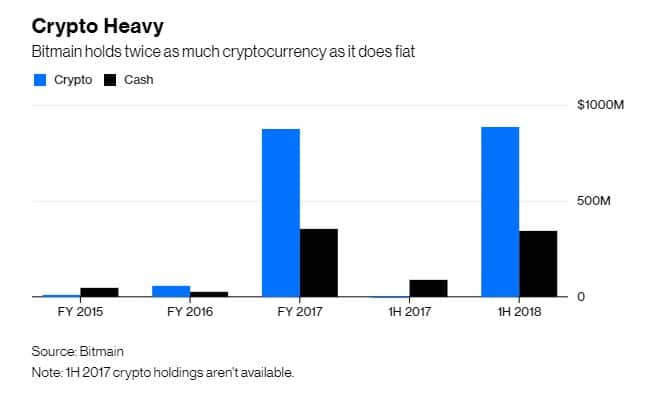

A: I think at this point Jihan has no choice but to list on the HKEX. First, they raised a fair amount of capital from Pre-IPO investors that expect Bitmain to go public. Secondly, Bitmain desperately needs the additional capital that a public offering could bring. If you look at their financials, their current cash position is almost entirely from their recent investors, and they are burning through Q1 profits quickly. Without a new mining machine on the market in the coming months, Bitmain will likely finish 2018 in the red.

관련

기사제보 및 보도자료: press@blockmedia.co.kr

▶ 블록미디어 유튜브 바로가기 https://www.youtube.com/blockmedia

▶ 블록미디어 텔레그램 바로가기 https://t.me/blockmedia

▶ 블록미디어 페이스북 바로가기 https://www.facebook.com/blockmediakorea/