Bitcoin trading in South Korea fell by 78 percent in December from November, mainly due to the prolonged bearish market, repeated hackings and computer software breakdowns.

The CryptoCompare reported global Bitcoin trading accounted for 57 percent of all cryptocurrency tradings last month. It said a 78 percent downfall in the transaction of Bitcoin through the Korean currency.

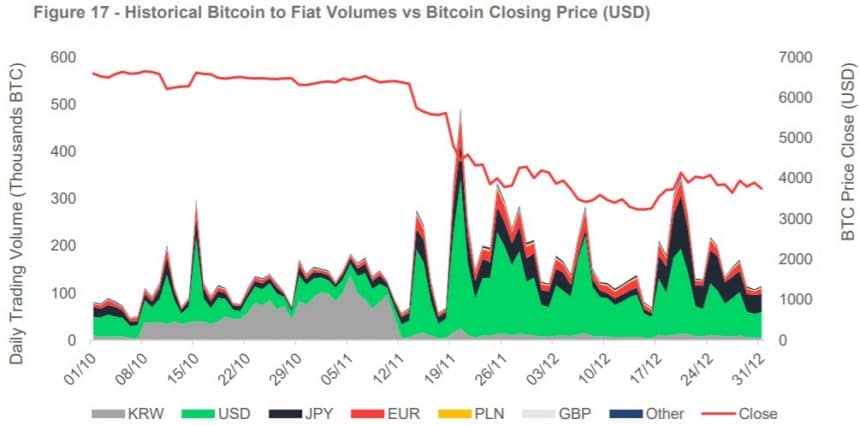

The agency reported a 1.3 percent hike in the U.S. dollar trading of Bitcoin last month from a month ago. The yen-based trading of Bitcoin rose 28 percent. A total of 2.88 million Bitcoins was cleared through dollars while 1.19 million Bitcoins were settled via yen. Only 400,000 Bitcoins were traded in the Korean currency.

Bitcoin prices were 2 percent lower in South Korea than overseas. Investors call this phenomenon as the reverse Kimchi premium. So far Bitcoin and other major cryptocurrency prices have been higher in South Korea than in other countries.

Analysts said many South Korean investors seemed to expect little over upbound of the market. They also predict the government not to lift its crackdown on the cryptocurrency market. Many investors holding ‘expensive’ cryptocurrencies began to dispose of their holdings.

Major South Korean exchanges are desperate to attract investors. They are holding a series of ‘airdrop’ events, providing coins free of charge to investors.

From November through December, Bithumb offered 100 million won worth of Bithumb to an investor out of those who logged in the exchange during the promotional event.

관련

기사제보 및 보도자료: press@blockmedia.co.kr

▶ 블록미디어 유튜브 바로가기 https://www.youtube.com/blockmedia

▶ 블록미디어 텔레그램 바로가기 https://t.me/blockmedia

▶ 블록미디어 페이스북 바로가기 https://www.facebook.com/blockmediakorea/