Coinone Transfer became South Korea’s first blockchain-based remittance service provider this month. Through the service, people can remit funds to Thailand and the Philippines at a faster and lower cost.

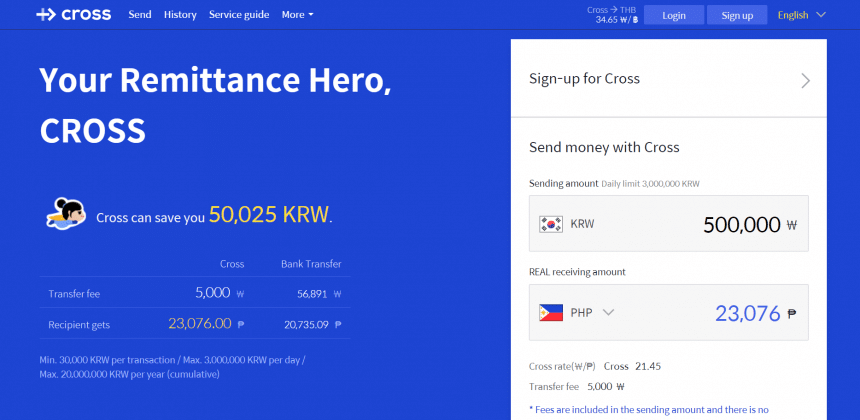

This month, it made public the remittance mobile app and web service, called Cross. It is popular among two million foreigners in South Korea, about 2.3 percent of the population.

They can send money to their loved ones at home through the Cross service. The remittance is possible even though senders have no bank accounts.

The company adopted Ripple’s advanced blockchain technology, called RippleNet, which has a high degree of payment transparency and reliability.

It also formed partnerships with Siam Commercial Bank (SCB) in Thailand and Cebuana Lhuillier in the Philippines.

Cross customers can gain a direct access to PromptPay, which allows anyone with a bank account in Thailand to receive money directly and instantly.

About 153,000 Thai workers are in Korea, the third-largest Asian migrant worker population. About 58,000 Filipino and Filipina are working in Korea, according to Statistics Korea.

People complain over remittance through banks. Remittance fee is extremely high. Senders and recipients do not know exactly when the remittance is made. No cancellation is possible once remittance is in progress.

The Cross charges remittance fees at 1 percent of the amount, and transfer time is around 5 minutes, compared with 4-6 percent service fee at banks and two-or three-day remittance time.

Coinone is to get a government approval to raise the maximum remittance limit beyond the current 20 million won per year.

Currently, up to 1.5 million won and 3 million won can be sent each time to Thailand and the Philippines, respectively.

Coinone is the cryptocurrency exchange but is branched out into a remittance service business.

관련

기사제보 및 보도자료: press@blockmedia.co.kr

▶ 블록미디어 유튜브 바로가기 https://www.youtube.com/blockmedia

▶ 블록미디어 텔레그램 바로가기 https://t.me/blockmedia

▶ 블록미디어 페이스북 바로가기 https://www.facebook.com/blockmediakorea/